Use EasyAutofill for

industries

The due diligence process remains one of the most time-intensive and costly phases in any M&A transaction. Corporate law teams must review thousands of documents, analyse complex responses, and cross-check every disclosure against a growing list of buyer or seller requirements.

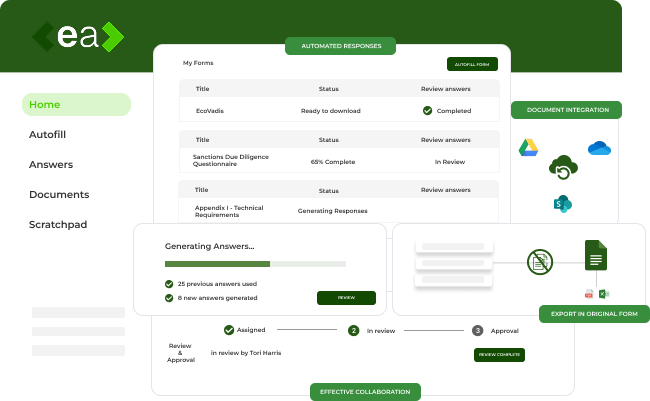

EA transforms this process. Using advanced AI trained on corporate transaction workflows, EA automates large parts of legal due diligence, helping law firms and their clients accelerate deal timelines, reduce human error, and protect deal value on both buy-side and sell-side engagements.

Request Demo

Buyers’ legal teams must verify vast amounts of seller-provided data across multiple folders and formats.

Manual cross-checking of disclosure schedules, data rooms, and due diligence questionnaires (DDQs) drains legal hours and introduces risk.

Sellers struggle to produce complete, consistent, and commercially sensitive responses that protect deal value while meeting disclosure obligations.

EA delivers an intelligent due diligence assistant that enhances both buy-side and sell-side processes.

Intelligent Cross-Checking

EA validates that all documents listed on an Information Request Letter (IRL) are present in the data room, flagging missing or duplicate files.

DDQ Answer Verification

EA runs your due diligence questionnaire through the dataset — automatically checking seller answers against uploaded materials.

Smart Follow-Up Generation

For incomplete or vague answers, EA proposes targeted follow-up questions, saving reviewers hours of manual drafting.

Guided DD Response Drafting

EA helps sellers prepare accurate, well-structured responses to buyer DDQs, maintaining compliance while protecting negotiation leverage.

Gap Detection and Data Consistency

The system identifies inconsistencies or missing disclosures before the buyer does — reducing surprises and preserving deal confidence.

Sync or upload the data room to EA.

Optional: Check all documents on the Information Request Letter (IRL) are in the dataroom.

Upload the due diligence questions and state whether you’re representing buy side or sell side.

EA will draft responses and follow-up questions if required for you to review or send to your client to finalise.

Pay per use — only pay when you use it, at a fraction of the cost of an employee.

AI can analyse information far quicker than humans.

Cuts document review time by up to 80%

Protects value and speeds readiness

Compliant with client confidentiality and data-handling standards.

Accelerates buyer-seller Q&A cycles.

Take the next step: sign up or check out our pricing options.